hi,

I have recently been approached by 'deVere group' a financial consulting company.

Has anyone dealt with them?

any advice, words of wisdom to share?

thanks

hi,

I have recently been approached by 'deVere group' a financial consulting company.

Has anyone dealt with them?

any advice, words of wisdom to share?

thanks

hi,

I have recently been approached by 'deVere group' a financial consulting company.

Has anyone dealt with them?

any advice, words of wisdom to share?

thanks

Companies such as DeVere or Churchill "hunt down" the xpats in Geneva by searching Linked for foreign sounding names working abroad, then claim that someone you know referred you....

They claim that they don't want to sell you anything.... but they do that's their main objective.

I met them once at the begining ... a waste of time for me... but it's free so if you have the time and want some sort of financial assesment done then why not.

Companies such as DeVere or Churchill "hunt down" the xpats in Geneva by searching Linked for foreign sounding names working abroad, then claim that someone you know referred you....

They claim that they don't want to sell you anything.... but they do that's their main objective.

I met them once at the begining ... a waste of time for me... but it's free so if you have the time and want some sort of financial assesment done then why not.

Stay away from them. Annoying bunch of people trying to tie you down for a product for years to come. Liars - stalkers etc etc. go to a proper financial advisor who might cost something, but has no hidden agenda in just trying to get as much commission as possible.

Stay away from them. Annoying bunch of people trying to tie you down for a product for years to come. Liars - stalkers etc etc. go to a proper financial advisor who might cost something, but has no hidden agenda in just trying to get as much commission as possible.

Stay away from them. Annoying bunch of people trying to tie you down for a product for years to come. Liars - stalkers etc etc. go to a proper financial advisor who might cost something, but has no hidden agenda in just trying to get as much commission as possible.

Would agree with Martin. Have had so many called usually from some sloaney home counties twat drawling, "HiiiiIIiiii. I'm Tarquin MacWankstain. I understand you had a long chat with my colleague expressing interest in our products. Mind if I waste you time for half an hour?" You'll get these once a week from different people until you write to them telling them that you don't take financial advice from people who are too f--king stupid not to pass on a message saying, "Never call me again!"

Would agree with Martin. Have had so many called usually from some sloaney home counties twat drawling, "HiiiiIIiiii. I'm Tarquin MacWankstain. I understand you had a long chat with my colleague expressing interest in our products. Mind if I waste you time for half an hour?" You'll get these once a week from different people until you write to them telling them that you don't take financial advice from people who are too f--king stupid not to pass on a message saying, "Never call me again!"

They do have some risky but rewarding financial products like Autocall notes and regular income notes. I have bought a couple of their products and have been happy thus far. You should check for urself if u want to have those kind of products to diversify ur portfolio.

They do have some risky but rewarding financial products like Autocall notes and regular income notes. I have bought a couple of their products and have been happy thus far. You should check for urself if u want to have those kind of products to diversify ur portfolio.

I felt I was missold by the guy i first met - bullied almost. Made me feel stupid for not investing so i invested - one vehicle is much more risky than I had realised and I was told I could stop the other one at any time (after an initial period) but it seems I cannot

The newer guy is better

I felt I was missold by the guy i first met - bullied almost. Made me feel stupid for not investing so i invested - one vehicle is much more risky than I had realised and I was told I could stop the other one at any time (after an initial period) but it seems I cannot

The newer guy is better

In the beginning, they said that the condition for obtaining the brilliant advice theye wer going to give me they asked for names of my friends they could contact. I refused. They initially said in which case they could not give me their brilliant advice, but soon backed off when I said OK forget it then

In the beginning, they said that the condition for obtaining the brilliant advice theye wer going to give me they asked for names of my friends they could contact. I refused. They initially said in which case they could not give me their brilliant advice, but soon backed off when I said OK forget it then

I had one of them on the phone about a year ago. A friend gave them my number and he wanted to meet me. I said it couldn't have been much of a friend, and that I was not interested.

He asked me why not. I know that these guys work off a script and I didn't want to give him any help so he could keep talking to me, so I just said 'I'm seriously not interested'.

It didn't help, and from that moment I thought: If you're going to waste my time I'm going to waste yours (I've been making fun of telemarketers since I was 20).

He talked for a couple of minutes. I asked him if he spoke German, he did, and he did the whole speech in German. Then I told him that my German wasn't great, so if he could try it in French. He did, although he kept it very short. I then told him in 3 languages that I wasn't interrested, and he gave up.

I had one of them on the phone about a year ago. A friend gave them my number and he wanted to meet me. I said it couldn't have been much of a friend, and that I was not interested.

He asked me why not. I know that these guys work off a script and I didn't want to give him any help so he could keep talking to me, so I just said 'I'm seriously not interested'.

It didn't help, and from that moment I thought: If you're going to waste my time I'm going to waste yours (I've been making fun of telemarketers since I was 20).

He talked for a couple of minutes. I asked him if he spoke German, he did, and he did the whole speech in German. Then I told him that my German wasn't great, so if he could try it in French. He did, although he kept it very short. I then told him in 3 languages that I wasn't interrested, and he gave up.

Yes, same thing - A colleague of mine gave them my name - i was pestered, but I was weak eventually i gave in

Yes, same thing - A colleague of mine gave them my name - i was pestered, but I was weak eventually i gave in

Would agree with Martin. Have had so many called usually from some sloaney home counties twat drawling, "HiiiiIIiiii. I'm Tarquin MacWankstain. I understand you had a long chat with my colleague expressing interest in our products. Mind if I waste you time for half an hour?" You'll get these once a week from different people until you write to them telling them that you don't take financial advice from people who are too f--king stupid not to pass on a message saying, "Never call me again!"

Luvvit-sounds like a sketch from harry and Paul!!!

Luvvit-sounds like a sketch from harry and Paul!!!

I always felt like I was talking to someone like this when they called...

What kind of "investment professional" cold calls people, sells to them in their living room and bullies them for names of friends so they can pretend they have been 'referred' ?

Ive had calls in the last 2 weeks from devere, Globalpie and guardian .. all the same pitch.

Selling these structured autocall notes (as high income products, which they are not ), to inexperienced customers. When Lehmann brothers went down, people lost almost ecverything !

Why do they do it ? because it makes them more commission and because they dont have any in depth investment research to provide true portfolio management

Cheaper, more diversified and tax efficient products are available on the Swiss market.

Dont fall for the BS !

What kind of "investment professional" cold calls people, sells to them in their living room and bullies them for names of friends so they can pretend they have been 'referred' ?

Ive had calls in the last 2 weeks from devere, Globalpie and guardian .. all the same pitch.

Selling these structured autocall notes (as high income products, which they are not ), to inexperienced customers. When Lehmann brothers went down, people lost almost ecverything !

Why do they do it ? because it makes them more commission and because they dont have any in depth investment research to provide true portfolio management

Cheaper, more diversified and tax efficient products are available on the Swiss market.

Dont fall for the BS !

Nobody has written a review yet...

I know that this company has a big turnover, their "financal advisors" change every 6 month. They sell product without making a financal study of your situation and expectation, so I recommand you to compare 2,3 brokers or financal company before investing.

I know that this company has a big turnover, their "financal advisors" change every 6 month. They sell product without making a financal study of your situation and expectation, so I recommand you to compare 2,3 brokers or financal company before investing.

In the beginning, they said that the condition for obtaining the brilliant advice theye wer going to give me they asked for names of my friends they could contact. I refused. They initially said in which case they could not give me their brilliant advice, but soon backed off when I said OK forget it then

Its kinda ridiculous, that you should be put in that position Helene.

Seriously, if you want to do your valued friends and colleaugues a favour, you would be better off showing them this thread, than giving their names to the offshore 'advisers'

Its kinda ridiculous, that you should be put in that position Helene.

Seriously, if you want to do your valued friends and colleaugues a favour, you would be better off showing them this thread, than giving their names to the offshore 'advisers'

I know guys these telesales people can suck...I know it well. But keep in mind that sort of job is not the easiest and some of them might not have better choice.

I personally try my best to be polite even if I have to repeat several times I'm not interested.

I know guys these telesales people can suck...I know it well. But keep in mind that sort of job is not the easiest and some of them might not have better choice.

I personally try my best to be polite even if I have to repeat several times I'm not interested.

Would you let an unqualified and inexperienced surgeon operate on you??

From January 2013 all UK financial advisers hvae to be level 4 qualified as a minimum and have relevant experience in certain areas. You can check a list of qualified advisers on www.cii.co.uk

If you want more info send me a mail.....

Would you let an unqualified and inexperienced surgeon operate on you??

From January 2013 all UK financial advisers hvae to be level 4 qualified as a minimum and have relevant experience in certain areas. You can check a list of qualified advisers on www.cii.co.uk

If you want more info send me a mail.....

I know guys these telesales people can suck...I know it well. But keep in mind that sort of job is not the easiest and some of them might not have better choice.

I personally try my best to be polite even if I have to repeat several times I'm not interested.

Absolutely disagree. I accept that they may ignore the first time I say 'I'm not interested', but if they continue after the second time it's harrassment.

Absolutely disagree. I accept that they may ignore the first time I say 'I'm not interested', but if they continue after the second time it's harrassment.

Its kinda ridiculous, that you should be put in that position Helene.

Seriously, if you want to do your valued friends and colleaugues a favour, you would be better off showing them this thread, than giving their names to the offshore 'advisers'

yes wilycoyote - which is why i refused to give my freinds names ... I value them too much ...

wish I had listened to my gut instinct ... but I got sucked in by being ( @ Nun) polite and not firm like Edward was

it could cost me a lot !

yes wilycoyote - which is why i refused to give my freinds names ... I value them too much ...

wish I had listened to my gut instinct ... but I got sucked in by being ( @ Nun) polite and not firm like Edward was

it could cost me a lot !

They seem to call me every six months. I guess each time the last guy passes my name on to the next newbie. Not sure what they sell these days as I politely say that I'm not interested. Before they were always trying to sell me an offshore pension scheme that they said would be tax free. My question was the following: "If it's not 2ème pillier and not 3ème pillier A, how can it be tax free?" They would then tell me that it is tax free because it is in Guernsey. Obviously anyone with a little nouse would realise that no tax in Guernsey, is not the same as tax-free in Switzerland. Whatever they tell you, don't forget that you have to put the income AND value on your Swiss tax return.

They seem to call me every six months. I guess each time the last guy passes my name on to the next newbie. Not sure what they sell these days as I politely say that I'm not interested. Before they were always trying to sell me an offshore pension scheme that they said would be tax free. My question was the following: "If it's not 2ème pillier and not 3ème pillier A, how can it be tax free?" They would then tell me that it is tax free because it is in Guernsey. Obviously anyone with a little nouse would realise that no tax in Guernsey, is not the same as tax-free in Switzerland. Whatever they tell you, don't forget that you have to put the income AND value on your Swiss tax return.

you

Thanks everyone for their contributions to this thread — I did some research ahead of a meeting resulting from a cold call right about the time I was considering getting some financial advice. I found a trove of colourful complaints, various arcitlces about suppression of same, video and blog retorts by the founder, and an article about $50m of clients' money going into a failed fund owned by the CEO. I don't know about the veracity of any/all of this information, and I'm sure they have some satisfied clients, but I make my investment decisions based on both intelligence (like this) and instinct, and neither are positive. As such I canceled the meeting and asked to be added to their "do not call" list.

For context, I was previously pitched a complex product betting on indexes by a sales guy near my place in Zürich and I had a bad feeling then too. In the interim I was approached by another US firm who wanted me to invest in Barnes & Noble on a tip, which would have left me underwater. My new policy is to never invest on any inbound financial advice, rather to go seeking that advice myself. I suggest that's the safer way to do it.

Thanks everyone for their contributions to this thread — I did some research ahead of a meeting resulting from a cold call right about the time I was considering getting some financial advice. I found a trove of colourful complaints, various arcitlces about suppression of same, video and blog retorts by the founder, and an article about $50m of clients' money going into a failed fund owned by the CEO. I don't know about the veracity of any/all of this information, and I'm sure they have some satisfied clients, but I make my investment decisions based on both intelligence (like this) and instinct, and neither are positive. As such I canceled the meeting and asked to be added to their "do not call" list.

For context, I was previously pitched a complex product betting on indexes by a sales guy near my place in Zürich and I had a bad feeling then too. In the interim I was approached by another US firm who wanted me to invest in Barnes & Noble on a tip, which would have left me underwater. My new policy is to never invest on any inbound financial advice, rather to go seeking that advice myself. I suggest that's the safer way to do it.

I hear Martin Scorsese is making a film about them - "The Wolf of the Rue du Rhône"

I hear Martin Scorsese is making a film about them - "The Wolf of the Rue du Rhône"

I can only add to everything stated above. I was sold a "pension plan" a few years ago by an independent advisor which is based in isle of man. I was approached by de Vere in much the same way as everyone else and I finally agreed to a meeting. He didn't seem to think it was a problem that he was selling me effectively the same product again and I grilled him for 2 hours on fees and structures of the investment. I felt I did not really get the answers I wanted, so I did some more research on this type of company.

I understand that these guys sell contracts from other firms - like zurich international - and they need to lock you into the payment scheme for a set period of time - 18 months or longer. You are contratually obliged to pay every month, and De Vere will get an upfront introduction fee for snagging you. No wonder they are so keen to sign you up. I then looked into the fees again and I wish I had not invested at all - many articles spoke about hidden fees, and that any positive return would be eaten away by their fixed fees, which are not linked to performance. So, these companies like Zurich publish their own literature with their own rating of each fund but I feel this is misleading. I ended up investing around 10,000 and I've made about 3% over the past 4 years; I would have been better off in cash to be honest.

After I declined to sign a contract, I kept being harangued by them on the phone and eventually asked them to stop calling. I then started to get messages on LinkedIn and I have the impression these guys just sit there all day trying to find leads on expats to cold call. I would never sign up with a company like this. Why would you ring fence £10,000 that you can effectively never access (until retirement) with an early redemption sum of less than 30% of that, if you needed it. Much better to buy an index tracking ETF scheme and just watch it grow - the tax you pay on this is just for the peace of mind of being able to access it should your life sirtuation change. I switched my investment in the end to high income bonds - and when I called them to find out more information on the interest dates or past distributions, no one was able to advise me.

My advice, stay the hell away from these guys.

I can only add to everything stated above. I was sold a "pension plan" a few years ago by an independent advisor which is based in isle of man. I was approached by de Vere in much the same way as everyone else and I finally agreed to a meeting. He didn't seem to think it was a problem that he was selling me effectively the same product again and I grilled him for 2 hours on fees and structures of the investment. I felt I did not really get the answers I wanted, so I did some more research on this type of company.

I understand that these guys sell contracts from other firms - like zurich international - and they need to lock you into the payment scheme for a set period of time - 18 months or longer. You are contratually obliged to pay every month, and De Vere will get an upfront introduction fee for snagging you. No wonder they are so keen to sign you up. I then looked into the fees again and I wish I had not invested at all - many articles spoke about hidden fees, and that any positive return would be eaten away by their fixed fees, which are not linked to performance. So, these companies like Zurich publish their own literature with their own rating of each fund but I feel this is misleading. I ended up investing around 10,000 and I've made about 3% over the past 4 years; I would have been better off in cash to be honest.

After I declined to sign a contract, I kept being harangued by them on the phone and eventually asked them to stop calling. I then started to get messages on LinkedIn and I have the impression these guys just sit there all day trying to find leads on expats to cold call. I would never sign up with a company like this. Why would you ring fence £10,000 that you can effectively never access (until retirement) with an early redemption sum of less than 30% of that, if you needed it. Much better to buy an index tracking ETF scheme and just watch it grow - the tax you pay on this is just for the peace of mind of being able to access it should your life sirtuation change. I switched my investment in the end to high income bonds - and when I called them to find out more information on the interest dates or past distributions, no one was able to advise me.

My advice, stay the hell away from these guys.

They seem to call me every six months. I guess each time the last guy passes my name on to the next newbie. Not sure what they sell these days as I politely say that I'm not interested. Before they were always trying to sell me an offshore pension scheme that they said would be tax free. My question was the following: "If it's not 2ème pillier and not 3ème pillier A, how can it be tax free?" They would then tell me that it is tax free because it is in Guernsey. Obviously anyone with a little nouse would realise that no tax in Guernsey, is not the same as tax-free in Switzerland. Whatever they tell you, don't forget that you have to put the income AND value on your Swiss tax return.

There have been a number of initiatives in banking recently to catch up with people avoiding tax in "off shore" schemes - there was Rubik and now there's the FATCA program for US. Basically, if a UK person tries to hide money from the UK goverment by putting it in a swiss bank account, the swiss bank is now obliged to disclosure the details to the UK government so they can track you down. Either this, or you make an "anonymous" payment to catch up with your taxes.

If they eventually extend this "tax havens" such as Guernsey or IOM, then you might be obliged to pay back-dated taxes in the same way, but you will not be able to redeem your investment without taking a massive hit on the capital for early redemption.

In any case, these are not "tax free" investments - they are 99% life insurance with a 1% investment option added on. It's basically a loophole in the law they they could close anytime leaving you with your funds effectively trapped offshore, no change of accessing them, and taxed at the same rate as you would if you had kept them in a normal bank account.

There have been a number of initiatives in banking recently to catch up with people avoiding tax in "off shore" schemes - there was Rubik and now there's the FATCA program for US. Basically, if a UK person tries to hide money from the UK goverment by putting it in a swiss bank account, the swiss bank is now obliged to disclosure the details to the UK government so they can track you down. Either this, or you make an "anonymous" payment to catch up with your taxes.

If they eventually extend this "tax havens" such as Guernsey or IOM, then you might be obliged to pay back-dated taxes in the same way, but you will not be able to redeem your investment without taking a massive hit on the capital for early redemption.

In any case, these are not "tax free" investments - they are 99% life insurance with a 1% investment option added on. It's basically a loophole in the law they they could close anytime leaving you with your funds effectively trapped offshore, no change of accessing them, and taxed at the same rate as you would if you had kept them in a normal bank account.

Many big banks inc the one I work for have already or are in process of dropping these type of "introducers" ..

I've been called many times, usually reception at the office don't put calls through but a few get in.

I've told them "you obviously harvested my details from linked in, you know I work for a financial institution, why on earth do I need your cold call? I can get all the advice I need for free and discounts on all of the products.. "

But they insist that they can do it better blah blah blah .. I usually just hang up mid sentence.

Many big banks inc the one I work for have already or are in process of dropping these type of "introducers" ..

I've been called many times, usually reception at the office don't put calls through but a few get in.

I've told them "you obviously harvested my details from linked in, you know I work for a financial institution, why on earth do I need your cold call? I can get all the advice I need for free and discounts on all of the products.. "

But they insist that they can do it better blah blah blah .. I usually just hang up mid sentence.

There have been a number of initiatives in banking recently to catch up with people avoiding tax in "off shore" schemes - there was Rubik and now there's the FATCA program for US. Basically, if a UK person tries to hide money from the UK goverment by putting it in a swiss bank account, the swiss bank is now obliged to disclosure the details to the UK government so they can track you down. Either this, or you make an "anonymous" payment to catch up with your taxes.

If they eventually extend this "tax havens" such as Guernsey or IOM, then you might be obliged to pay back-dated taxes in the same way, but you will not be able to redeem your investment without taking a massive hit on the capital for early redemption.

In any case, these are not "tax free" investments - they are 99% life insurance with a 1% investment option added on. It's basically a loophole in the law they they could close anytime leaving you with your funds effectively trapped offshore, no change of accessing them, and taxed at the same rate as you would if you had kept them in a normal bank account.

You are completely correct in that these investments are not "tax free". They are instead tax efficient. They are legal and liable to tax. These, along with all investments, should be declared to the relevant tax authorities. As such, your reference to the UK government extending their disclosure requirements to IOM etc should have no baring on an individual.

What would affect these offshore and onshore bonds is if the government change the rules. From a technical point they are 100% investment and an additional 1% life insurance. It is not a loophole in the rules but has been created to encourage people to save - similar to individual savings accounts (ISAs) in the UK, pensions etc.

As with a lot of financial products investment bonds can be very usefull if they are used correctly. Of course, conversely, if they are used in the wrong manner they can be totally unsuitable.

As long as individuals are advised correctly and are open and transparent with the necessary authorities there should be no back dated taxes applicable.

You are completely correct in that these investments are not "tax free". They are instead tax efficient. They are legal and liable to tax. These, along with all investments, should be declared to the relevant tax authorities. As such, your reference to the UK government extending their disclosure requirements to IOM etc should have no baring on an individual.

What would affect these offshore and onshore bonds is if the government change the rules. From a technical point they are 100% investment and an additional 1% life insurance. It is not a loophole in the rules but has been created to encourage people to save - similar to individual savings accounts (ISAs) in the UK, pensions etc.

As with a lot of financial products investment bonds can be very usefull if they are used correctly. Of course, conversely, if they are used in the wrong manner they can be totally unsuitable.

As long as individuals are advised correctly and are open and transparent with the necessary authorities there should be no back dated taxes applicable.

I am working myself for an online broker and have 20 years of financial markets experience. But I have never seen anyone like these DeVere guys. They cold called me yesterday making up a story that they had important information to share regarding changes that would affect my future Irish pension. I don't have any Irish pension rights but they must have read on my linkedin profile that I worked in Ireland for a while. The problem is that there is no way stopping these people and their false claims to help you, even if you tell them you have no interest. They keep on going on until you tell them simply that you will end the conversation and you hang up. I am surprised they have not been stopped by regulators yet.

I am working myself for an online broker and have 20 years of financial markets experience. But I have never seen anyone like these DeVere guys. They cold called me yesterday making up a story that they had important information to share regarding changes that would affect my future Irish pension. I don't have any Irish pension rights but they must have read on my linkedin profile that I worked in Ireland for a while. The problem is that there is no way stopping these people and their false claims to help you, even if you tell them you have no interest. They keep on going on until you tell them simply that you will end the conversation and you hang up. I am surprised they have not been stopped by regulators yet.

Here CNBC Africa confronts de Vere's PONZI scheme!!

Watch this video about the fund - owned by their CEO that has been frozen for years now. 50% of our money tied up in it!!?

http://www.cnbcafrica.com/video/?bctid=4133226843001

I am finally coming out about how de Vere stole our retirement fund - Generali International Vision. We were pretty embarrassed so have been hesitant to expose our financial naiveté. Well, a friend of mine JW was a deVere rep. He dated 2 close girlfriends of mine, had eaten dinner at our home multiple times - so I thought I could trust him. My hisband wanted to start a retirement fund so he sought his advice. Of course, he said he could help and suggested we invest with them. He signed on - and "our friend" was to continue to council us each Q on what stocks to purchase, then we sign off on his advice. In late 2011, when we started the find he advised us to invest 50% of our monthly investment into a "great" fund the Strategic Growth Fund from UAM. The other investments were only 20% or 10%. So this was easily the largest monthly investment.

After a year or so, the fund was mysteriously FROZEN!? Meaning we couldn't invest it elsewhere - no growth nor withdrawal. My buddy, said don't worry they're just trying to liquidate, you will soon get back control of your money. Finally, we spoke with an real investment professional who said this looked fishy. After searching on the internet about this fund and de Veres, I found that, in fact, the fund had been linked to the CEO of de Veres, and a murder suicide in A. Afirca - The CEO was the owner of the fund (and thus gaining double commission on every transaction). I confronted my "friend" who denied everything, redirected my comments and then left the country... Then after about 10 email (back and forth) in spring 2012 demanding credentials and information (which they never supplied) we had a formal meeting with de Vere's Geneva where they rudely claimed they didn't even know what fund we were talking about. They weren't familiar with the fund details (since they've changed the name and ownership details yearly) and basically denied everything. The guy (Happy to look up his name and add it here) started getting extremely aggressive with me to intimidate me (I am his client mind you).

Sure, I am not a financial professional, but now I have learned that neither are the de Vere financial advisors - they are only sales people that go thru a training, but likely have NO finical background. After reporting this to the Geneva financial police, we learned that since we agreed to sign-off on our "advisors" choices, that we were ultimately responsible and there was little we could do except MAKE A SOCIAL MEDIA MESS for them!! As I said, I was hesitant as I felt embarrassed by my naiveté, however, now I am still looking forward to letting everyone one I know what happened.

I have more documents to share that I collected in 2012 - that strangely are no longer online. I am happy to help anyone else that has been through the deVere fleecing. We will be pursuring them

Here CNBC Africa confronts de Vere's PONZI scheme!!

Watch this video about the fund - owned by their CEO that has been frozen for years now. 50% of our money tied up in it!!?

http://www.cnbcafrica.com/video/?bctid=4133226843001

I am finally coming out about how de Vere stole our retirement fund - Generali International Vision. We were pretty embarrassed so have been hesitant to expose our financial naiveté. Well, a friend of mine JW was a deVere rep. He dated 2 close girlfriends of mine, had eaten dinner at our home multiple times - so I thought I could trust him. My hisband wanted to start a retirement fund so he sought his advice. Of course, he said he could help and suggested we invest with them. He signed on - and "our friend" was to continue to council us each Q on what stocks to purchase, then we sign off on his advice. In late 2011, when we started the find he advised us to invest 50% of our monthly investment into a "great" fund the Strategic Growth Fund from UAM. The other investments were only 20% or 10%. So this was easily the largest monthly investment.

After a year or so, the fund was mysteriously FROZEN!? Meaning we couldn't invest it elsewhere - no growth nor withdrawal. My buddy, said don't worry they're just trying to liquidate, you will soon get back control of your money. Finally, we spoke with an real investment professional who said this looked fishy. After searching on the internet about this fund and de Veres, I found that, in fact, the fund had been linked to the CEO of de Veres, and a murder suicide in A. Afirca - The CEO was the owner of the fund (and thus gaining double commission on every transaction). I confronted my "friend" who denied everything, redirected my comments and then left the country... Then after about 10 email (back and forth) in spring 2012 demanding credentials and information (which they never supplied) we had a formal meeting with de Vere's Geneva where they rudely claimed they didn't even know what fund we were talking about. They weren't familiar with the fund details (since they've changed the name and ownership details yearly) and basically denied everything. The guy (Happy to look up his name and add it here) started getting extremely aggressive with me to intimidate me (I am his client mind you).

Sure, I am not a financial professional, but now I have learned that neither are the de Vere financial advisors - they are only sales people that go thru a training, but likely have NO finical background. After reporting this to the Geneva financial police, we learned that since we agreed to sign-off on our "advisors" choices, that we were ultimately responsible and there was little we could do except MAKE A SOCIAL MEDIA MESS for them!! As I said, I was hesitant as I felt embarrassed by my naiveté, however, now I am still looking forward to letting everyone one I know what happened.

I have more documents to share that I collected in 2012 - that strangely are no longer online. I am happy to help anyone else that has been through the deVere fleecing. We will be pursuring them

Since I posted earlier in this thread these assh0les have got worse. DeVere especially..

I get called twice a week at work by them and since reception/security won't put their calls through, they now lie about who they are to get through saying they are from our Hong Kong branch or London office .. When i answer they start like an old mate, "hey John it's Tom, long time no speak, how's it going in Switzerland.. Thought i might drop by to talk, when are you free tomoro" ..

Most days I simply press the end call button on the phone without even speaking. Other days I play along for a few minutes .. "hey Tom .. Any time, where shall we meet, i was just thinking about you." Generally followed by some colourful language.. At which point they start shouting .. "no no don't hang up, i can really help you, wait wait, noooo..."

Whilst I symathise a tiny bit for people caught out by them, i defies all logic why anybody would trust their future wealth to people using these tactics .. It's like sending all your money to some dude in Nigeria who says you are the last relative of a billionaire. How can you possibly trust somebody who starts by deception?

Since I posted earlier in this thread these assh0les have got worse. DeVere especially..

I get called twice a week at work by them and since reception/security won't put their calls through, they now lie about who they are to get through saying they are from our Hong Kong branch or London office .. When i answer they start like an old mate, "hey John it's Tom, long time no speak, how's it going in Switzerland.. Thought i might drop by to talk, when are you free tomoro" ..

Most days I simply press the end call button on the phone without even speaking. Other days I play along for a few minutes .. "hey Tom .. Any time, where shall we meet, i was just thinking about you." Generally followed by some colourful language.. At which point they start shouting .. "no no don't hang up, i can really help you, wait wait, noooo..."

Whilst I symathise a tiny bit for people caught out by them, i defies all logic why anybody would trust their future wealth to people using these tactics .. It's like sending all your money to some dude in Nigeria who says you are the last relative of a billionaire. How can you possibly trust somebody who starts by deception?

There you go ... all out in public, named and shamed. Its not just de vere .. if you get cold called from somewhere around the airport you should draw your own conclusions.

And a flashy advert in the WRS glossy mag .. doesnt change their business model

There you go ... all out in public, named and shamed. Its not just de vere .. if you get cold called from somewhere around the airport you should draw your own conclusions.

And a flashy advert in the WRS glossy mag .. doesnt change their business model

Hello All,

We are developing a case agaist deVere, Switzerland - mainly concemring the Startegic GrowthFund (or GAM fund as it's sometimes called) pozi scheme and the Generali Vision plan retirement fund.

There's power in number so we are looking for anyone else that may have had the misfortune of being involved with deVere and these unsafe unvestmetns.

Please contact me if you've had similar experiences with deVeres or had any involvement with these funds and

Hello All,

We are developing a case agaist deVere, Switzerland - mainly concemring the Startegic GrowthFund (or GAM fund as it's sometimes called) pozi scheme and the Generali Vision plan retirement fund.

There's power in number so we are looking for anyone else that may have had the misfortune of being involved with deVere and these unsafe unvestmetns.

Please contact me if you've had similar experiences with deVeres or had any involvement with these funds and

Another video about deVere's involvement in the Belvedere ponzi scheme

http://youtu.be/9B4op1Kdmgs

Another video about deVere's involvement in the Belvedere ponzi scheme

http://youtu.be/9B4op1Kdmgs

Hi I am just about to surrender my fund with Generali Vision which i was advised to take by DeVere. I have put in a total of 73600 and my surrender return will be 52,000 odd thousand a reduction of 30%. Thieving bastards. Can you please let me know asap how your action has proceeded... I know inGermany they cannot now reduce the fund by taking all charges upfront anymore is that the same here???

regards

Martin

Hi I am just about to surrender my fund with Generali Vision which i was advised to take by DeVere. I have put in a total of 73600 and my surrender return will be 52,000 odd thousand a reduction of 30%. Thieving bastards. Can you please let me know asap how your action has proceeded... I know inGermany they cannot now reduce the fund by taking all charges upfront anymore is that the same here???

regards

Martin

I have a similar case, where we invested and now we are facing huge losses, penalties for not continuing our "investment." How can I help this case?

I have a similar case, where we invested and now we are facing huge losses, penalties for not continuing our "investment." How can I help this case?

Hi Feliz,

Did you ever take that case against De Vere? I am in the same boat and would like to take legal advice in order to stop payments and get most of my money back. I was tricked into 25 years policy. Any advice or contacts would be appreciate.

best regards

Paul

Hi Feliz,

Did you ever take that case against De Vere? I am in the same boat and would like to take legal advice in order to stop payments and get most of my money back. I was tricked into 25 years policy. Any advice or contacts would be appreciate.

best regards

Paul

Hello All,

We are developing a case agaist deVere, Switzerland - mainly concemring the Startegic GrowthFund (or GAM fund as it's sometimes called) pozi scheme and the Generali Vision plan retirement fund.

There's power in number so we are looking for anyone else that may have had the misfortune of being involved with deVere and these unsafe unvestmetns.

Please contact me if you've had similar experiences with deVeres or had any involvement with these funds and

Hi Feliz_S,

Good luck with this but unfortunatly, I think you will loose time, energy and money with lawyer.

The product you suscribed is a swiss 3rp Pillar isn't it?

Hi Feliz_S,

Good luck with this but unfortunatly, I think you will loose time, energy and money with lawyer.

The product you suscribed is a swiss 3rp Pillar isn't it?

Hi Tryky,

Thanks for your reply. This was the Generalli Vision Plan which is not part of the Swiss 3rd Pillar system. I've heard this product was not licensed to be sold by the Swiss financial regulators FINMA.

Best regards

Paul

Hi Tryky,

Thanks for your reply. This was the Generalli Vision Plan which is not part of the Swiss 3rd Pillar system. I've heard this product was not licensed to be sold by the Swiss financial regulators FINMA.

Best regards

Paul

I am a financial adviser and used to work for Devere. It was a terrrible sales driven environment, that gave no concern for the client. These long term saving plans, education saving plans or pension that they sell are not any of the above. They are an initial commision and thats it. The worst of them, which must be Generail Vision, runs at about 5% fees, so you have to then make 5% to break even.

The previous statement from a Devere employee states that "all employees in the UK are level 4 qualified". Well they have to be, and RDR compliant, the offshore ones no.

People do need financial advice, but please make sure there is complete disclosure regading commisions and fees and work with someone that is qualifed, either RDR compliant in the UK or RG146 compliant in Australia, that means at least the adviser has to have fuduciary responsiblity.

I am a financial adviser and used to work for Devere. It was a terrrible sales driven environment, that gave no concern for the client. These long term saving plans, education saving plans or pension that they sell are not any of the above. They are an initial commision and thats it. The worst of them, which must be Generail Vision, runs at about 5% fees, so you have to then make 5% to break even.

The previous statement from a Devere employee states that "all employees in the UK are level 4 qualified". Well they have to be, and RDR compliant, the offshore ones no.

People do need financial advice, but please make sure there is complete disclosure regading commisions and fees and work with someone that is qualifed, either RDR compliant in the UK or RG146 compliant in Australia, that means at least the adviser has to have fuduciary responsiblity.

I have invested with them, having been referred by someone. Some of the investments were good (or lucky), some terrible. Their agressive phone marketing is very annoying. They approached friends using me as a reference without asking me first. In 10 years they have changed my personal financial advisor 4 times and there is no handover between advisors. Watch out for the upfront charges on their products, I was sold Generalli Vision, investment in Euros which was not a good choice because of the upfront charges and the CHF/EUR exchange rate.

I have invested with them, having been referred by someone. Some of the investments were good (or lucky), some terrible. Their agressive phone marketing is very annoying. They approached friends using me as a reference without asking me first. In 10 years they have changed my personal financial advisor 4 times and there is no handover between advisors. Watch out for the upfront charges on their products, I was sold Generalli Vision, investment in Euros which was not a good choice because of the upfront charges and the CHF/EUR exchange rate.

They are a bunch of crooks. They sold me an "investment" with Generali that penalized me if I missed a scheduled payment, which I did, then had to liquidate to save any money whatsoever. They are not a fiduciary, so they are out for themselves. Run away as fast as you can.

They are a bunch of crooks. They sold me an "investment" with Generali that penalized me if I missed a scheduled payment, which I did, then had to liquidate to save any money whatsoever. They are not a fiduciary, so they are out for themselves. Run away as fast as you can.

You might be interested in yesterdays announcement by the SEC in relation to what looks like a class action brought against DeVere in the US. Switzerland has a regulatory framework but does not have parallel consumer protection where financial advice is concerned. Fiduciary and uintermediary relationships however, are covered by Art 400 of the Civil Code. Just Sayin ....

DeVere USA has agreed to pay an $8m civil penalty stemming from its failure to disclose upfront commission of 7% to clients who were encouraged to transfer their UK pensions via a Qrops, the US regulator has announced.

The affiliate was not named in the SEC document but described as a third-party product provider.

The SEC found that the undisclosed commission – including an amount equivalent to 7% of the pension transfer value – created an incentive for deVere USA to recommend a pension transfer and particular product or service providers.

The company also made materially misleading statements concerning tax treatment and available investment options, the regulator said.

Without admitting or denying the findings, deVere USA “consented to the SEC’s order, which finds the firm violated the Investment Advisers Act of 1940, including the antifraud provision, and imposes remedies that include an $8m (£6m, €6.8m) penalty and engaging an independent compliance consultant”, the SEC stated.

The US regulator also announced it is also taking separate action against two former deVere USA investment adviser representatives, one of whom was chief executive of the firm.

Charges have been filed against chief executive Benjamin Alderson and former manager Bradley Hamilton.

It is alleged that they misled clients and prospective clients about the benefits of pension transfers while concealing material conflicts of interest, including upfront commission of 7% that Alderson and Hamilton personally stood to receive.

The SEC’s complaint against Alderson and Hamilton alleges that they violated the Investment Advisers Act and it is seeking an injunction, disgorgement plus interest, and civil money penalties.

Marc Berger, director of the SEC’s New York regional office, said: “Investment advisers have an obligation to disclose direct and indirect financial incentives.

“DeVere USA brushed aside this duty while advising retail investors about their retirements assets, and today’s settlement will result in a Fair Fund distribution to deVere USA’s retail clients who were deprived of this information.”

A spokesperson for deVere USA said the company “is pleased to announce that the SEC has accepted its offer to settle an administrative proceeding relating to certain aspects of its historical business in the US”.

“The settlement clears that way for the company to continue to develop its investment advisory business in the US,” the spokesperson added.

DeVere USA has hired a new management team and “strengthened its overall systems and controls”.

“As part of its settlement with the SEC, the company has agreed to retain an independent compliance consultant to conduct annual reviews over the next three years,” the spokesperson said.

You might be interested in yesterdays announcement by the SEC in relation to what looks like a class action brought against DeVere in the US. Switzerland has a regulatory framework but does not have parallel consumer protection where financial advice is concerned. Fiduciary and uintermediary relationships however, are covered by Art 400 of the Civil Code. Just Sayin ....

DeVere USA has agreed to pay an $8m civil penalty stemming from its failure to disclose upfront commission of 7% to clients who were encouraged to transfer their UK pensions via a Qrops, the US regulator has announced.

The affiliate was not named in the SEC document but described as a third-party product provider.

The SEC found that the undisclosed commission – including an amount equivalent to 7% of the pension transfer value – created an incentive for deVere USA to recommend a pension transfer and particular product or service providers.

The company also made materially misleading statements concerning tax treatment and available investment options, the regulator said.

Without admitting or denying the findings, deVere USA “consented to the SEC’s order, which finds the firm violated the Investment Advisers Act of 1940, including the antifraud provision, and imposes remedies that include an $8m (£6m, €6.8m) penalty and engaging an independent compliance consultant”, the SEC stated.

The US regulator also announced it is also taking separate action against two former deVere USA investment adviser representatives, one of whom was chief executive of the firm.

Charges have been filed against chief executive Benjamin Alderson and former manager Bradley Hamilton.

It is alleged that they misled clients and prospective clients about the benefits of pension transfers while concealing material conflicts of interest, including upfront commission of 7% that Alderson and Hamilton personally stood to receive.

The SEC’s complaint against Alderson and Hamilton alleges that they violated the Investment Advisers Act and it is seeking an injunction, disgorgement plus interest, and civil money penalties.

Marc Berger, director of the SEC’s New York regional office, said: “Investment advisers have an obligation to disclose direct and indirect financial incentives.

“DeVere USA brushed aside this duty while advising retail investors about their retirements assets, and today’s settlement will result in a Fair Fund distribution to deVere USA’s retail clients who were deprived of this information.”

A spokesperson for deVere USA said the company “is pleased to announce that the SEC has accepted its offer to settle an administrative proceeding relating to certain aspects of its historical business in the US”.

“The settlement clears that way for the company to continue to develop its investment advisory business in the US,” the spokesperson added.

DeVere USA has hired a new management team and “strengthened its overall systems and controls”.

“As part of its settlement with the SEC, the company has agreed to retain an independent compliance consultant to conduct annual reviews over the next three years,” the spokesperson said.

I'm instantly enthusiastic about cold caller's products and ask them if they can just hold for a moment, then I check every few minutes that they're still holding, until they give up..

I'm instantly enthusiastic about cold caller's products and ask them if they can just hold for a moment, then I check every few minutes that they're still holding, until they give up..

I'm instantly enthusiastic about cold caller's products and ask them if they can just hold for a moment, then I check every few minutes that they're still holding, until they give up..

That’s an old dodge which, alas, doesn’t deter the “supervisor” from asking another employee

(often a newbie) from calling your number again a week or so later.

Does anyone have any other suggestions to block these irritating “cold calls”?

That’s an old dodge which, alas, doesn’t deter the “supervisor” from asking another employee

(often a newbie) from calling your number again a week or so later.

Does anyone have any other suggestions to block these irritating “cold calls”?

Hi Ritchie, Im afraid that cold calls from these high commission outsfits will not stop as long as they think they can get away with it.

What happended in the states is that investors who lost money took action to get compensation (or via the regulator), which raised the risks to them of substantial fines, criminal liability and higher reputational risks. Only then did they stop ...

Maybe the answer is better education. I heard last year of an HR dept of a large commodity trading firm actually letting these guys in to do seminars to staff. Unbelievable !

Anyway, i think the cold calls are a nuisance but really its only action to recover investors' financial losses and involving the regulators, that will solve this.

Cheers

Hi Ritchie, Im afraid that cold calls from these high commission outsfits will not stop as long as they think they can get away with it.

What happended in the states is that investors who lost money took action to get compensation (or via the regulator), which raised the risks to them of substantial fines, criminal liability and higher reputational risks. Only then did they stop ...

Maybe the answer is better education. I heard last year of an HR dept of a large commodity trading firm actually letting these guys in to do seminars to staff. Unbelievable !

Anyway, i think the cold calls are a nuisance but really its only action to recover investors' financial losses and involving the regulators, that will solve this.

Cheers

Hello, I have a similar problem as most people in the thread, invested in this Generali plan, it loses money but I am stuck in it for 25 years, with a very low surrender money if I stop now. Did anybody find a solution ? I am living in Germany now but signed up the plan in Switzerland.

Hello, I have a similar problem as most people in the thread, invested in this Generali plan, it loses money but I am stuck in it for 25 years, with a very low surrender money if I stop now. Did anybody find a solution ? I am living in Germany now but signed up the plan in Switzerland.

Keep away as others have said - i say this from exprience. I know the activities of this bunch have generated a lot of comments on the forum. I've now had a chunk of my pension written off as a result of their investment decisions. Is there anyone who would like to discuss a plan to go after them meaningfully? As a first suggestion perhaps we could meet up, swap notes and dscuss? Let me know if anyone would be willing to do this?

Anyone else please spread the word - if they come near you put the phone down.

Keep away as others have said - i say this from exprience. I know the activities of this bunch have generated a lot of comments on the forum. I've now had a chunk of my pension written off as a result of their investment decisions. Is there anyone who would like to discuss a plan to go after them meaningfully? As a first suggestion perhaps we could meet up, swap notes and dscuss? Let me know if anyone would be willing to do this?

Anyone else please spread the word - if they come near you put the phone down.

This is an interesting thread! Thing is I know lots of people who have lost money investing with UBS, HSBC, Barclays - the list could go on and on! I had a friend who lost over 50% of his 2nd Pillar with UBS - just one year after he retired. I am not being having a go at those companies! as there will be lots of people happy with them.

I have been a client of deVere since 2010. I moved my UK pension with devere and 9 years later it has grown by almost 50%, I also took a recommended savings plan with them, yes Generali!!!!! only took a 10-year plan and yes, I did read all the terms and conditions!!! I therefor new it had no surrender value in the first year and very little in the first 5 years. BUT I took out a 10-year plan! not a 1, 2 or 3-year plan! My Generali plan now has about 18 months left to run, it is also worth 40% more than I have put in!

And yes, I was cold called by deVere (Thank god, they did), I have also recommended them to some of my friends and colleagues, who also seem very happy with the service and advice received.

It is fair to say (In my opinion (that perhaps not all devere consultants are good! then again, no company has 100% perfect employees! look at your own companies!

The biggest problem is clients who don’t read terms and conditions. take a long-term savings plan, circumstances change, then they want their money back! really, try telling the bank after a few years that you no longer want to continue paying your mortgage!

I think most people on this thread need to grow up and take responsibility for their own decisions and mistakes! If you just take the advice from a sharp suited spotty faced sales person, without looking at their qualifications, then trust them to look after your, pension and or life savings, you must be a muppet!

I did my research; my advisor was fully qualified and came recommended! I do not work with the original advisor as he moved to a new country but he still stays in touch and I have not had a problem with any of the advisors I have worked with since!

This is an interesting thread! Thing is I know lots of people who have lost money investing with UBS, HSBC, Barclays - the list could go on and on! I had a friend who lost over 50% of his 2nd Pillar with UBS - just one year after he retired. I am not being having a go at those companies! as there will be lots of people happy with them.

I have been a client of deVere since 2010. I moved my UK pension with devere and 9 years later it has grown by almost 50%, I also took a recommended savings plan with them, yes Generali!!!!! only took a 10-year plan and yes, I did read all the terms and conditions!!! I therefor new it had no surrender value in the first year and very little in the first 5 years. BUT I took out a 10-year plan! not a 1, 2 or 3-year plan! My Generali plan now has about 18 months left to run, it is also worth 40% more than I have put in!

And yes, I was cold called by deVere (Thank god, they did), I have also recommended them to some of my friends and colleagues, who also seem very happy with the service and advice received.

It is fair to say (In my opinion (that perhaps not all devere consultants are good! then again, no company has 100% perfect employees! look at your own companies!

The biggest problem is clients who don’t read terms and conditions. take a long-term savings plan, circumstances change, then they want their money back! really, try telling the bank after a few years that you no longer want to continue paying your mortgage!

I think most people on this thread need to grow up and take responsibility for their own decisions and mistakes! If you just take the advice from a sharp suited spotty faced sales person, without looking at their qualifications, then trust them to look after your, pension and or life savings, you must be a muppet!

I did my research; my advisor was fully qualified and came recommended! I do not work with the original advisor as he moved to a new country but he still stays in touch and I have not had a problem with any of the advisors I have worked with since!

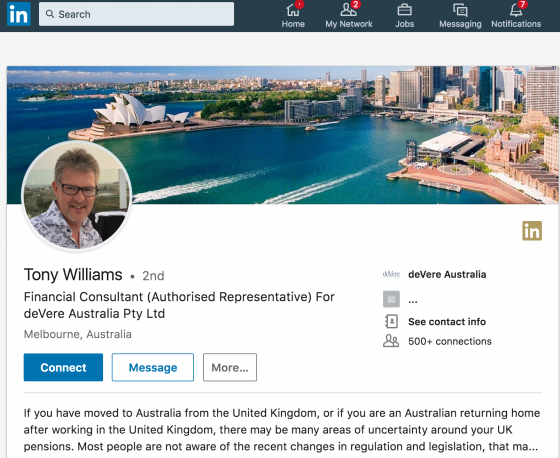

FAKE NEWS Tony W. of deVere Australia - formerly in Geneva,

Hahaha, indeed, you follow this thread closely and find it very interesting. You're up to the same pathetic deVere tactics of fake publicity. Seiously how could any self respecting person do this!? Ah, you work for deVere…

Do you really think we're all so naive to believe your nonsense!? I hope everyone here denounces you for the sneaky slimball you are. Here's where you can find him folks:

https://www.linkedin.com/in/tonywilliamsdeveregroup/

FAKE NEWS Tony W. of deVere Australia - formerly in Geneva,

Hahaha, indeed, you follow this thread closely and find it very interesting. You're up to the same pathetic deVere tactics of fake publicity. Seiously how could any self respecting person do this!? Ah, you work for deVere…

Do you really think we're all so naive to believe your nonsense!? I hope everyone here denounces you for the sneaky slimball you are. Here's where you can find him folks:

https://www.linkedin.com/in/tonywilliamsdeveregroup/

You make a good point Tony - we can all read and i indeed have a Vision policy where i was fully aware of the lock ins and costs.

What's different in my case is the salesman, who was not a spotty herbert as you describe, placed a portion of my transferred pension into a fund called the Strategic Growth Fund 3 months before it was suspended. It also trasnpires that through a spiderweb of ownership strcutures this fund was connect to the de Vere CEO. In addition it was investing in illiquid property assets rather than lower-risk assets as one would expect a pension to.

If you have 50% returns on a pension over less than 10 years and 40% over the same period with Vision then you should indeed be celebrating.

You make a good point Tony - we can all read and i indeed have a Vision policy where i was fully aware of the lock ins and costs.

What's different in my case is the salesman, who was not a spotty herbert as you describe, placed a portion of my transferred pension into a fund called the Strategic Growth Fund 3 months before it was suspended. It also trasnpires that through a spiderweb of ownership strcutures this fund was connect to the de Vere CEO. In addition it was investing in illiquid property assets rather than lower-risk assets as one would expect a pension to.

If you have 50% returns on a pension over less than 10 years and 40% over the same period with Vision then you should indeed be celebrating.

Feliz i didn't see this before i posted - well done.

If he could indeed geenrate a 50% return on a pension investment other than by timing bitcoin then i guess he would be living overlooking the Sydney Opera house rather than paying for his own toilet paper in the WTC :)

Feliz i didn't see this before i posted - well done.

If he could indeed geenrate a 50% return on a pension investment other than by timing bitcoin then i guess he would be living overlooking the Sydney Opera house rather than paying for his own toilet paper in the WTC :)

Yeah, it was too good to be true. Shithead Tony. He also didn’t say how their financial advisors continually bullshit you into investing in the latest best advisor paying investments such as strategic fund for them to fail and you lose money. They are not interested in you gaining only themselves through commissions…. bullshitting conmen avoid them like the plague

Yeah, it was too good to be true. Shithead Tony. He also didn’t say how their financial advisors continually bullshit you into investing in the latest best advisor paying investments such as strategic fund for them to fail and you lose money. They are not interested in you gaining only themselves through commissions…. bullshitting conmen avoid them like the plague

Well... it's the 1st of April afterall today. So our Aussie friend Tony can always claim April fools right ;-) jeez that these sharks are still around....

Well... it's the 1st of April afterall today. So our Aussie friend Tony can always claim April fools right ;-) jeez that these sharks are still around....

Yup, it's just more lies. This man's a total bottom feeder and has been watching this post for years and trying to influence the conversation with false information. He removed his photo some time ago, but he's been lurking on all the deVere threads.

His actions, even here on this thread, are a perfect example of who this man is - he's a true con artist. I just don't understand why people don't denounce him and how anyone could actually take this man seriously.

Yup, it's just more lies. This man's a total bottom feeder and has been watching this post for years and trying to influence the conversation with false information. He removed his photo some time ago, but he's been lurking on all the deVere threads.

His actions, even here on this thread, are a perfect example of who this man is - he's a true con artist. I just don't understand why people don't denounce him and how anyone could actually take this man seriously.