While the time to change your health insurance is now over, I wanted to share with you an observation I did regarding the compulsory health insurance in Switzerland.

I decided to optimize my deductible. Many health insurance companies offer different monthly primes depending on the deductible you choose. If your deductible is high, your prime will be lower, because the insurance company only begins to pay after you have exhausted your deductible. Anyhow, once your deductible is exhausted, you still have to pay 10% of the remaining costs, with a limit of 700 CHF per year (for an adult), this is what the Swiss call 'quote part'.

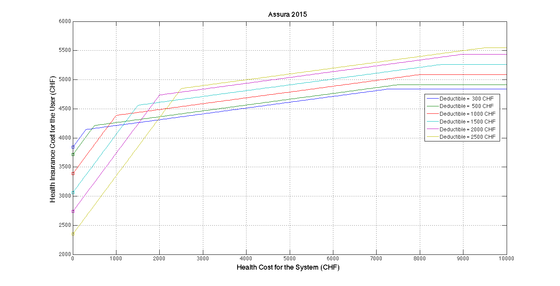

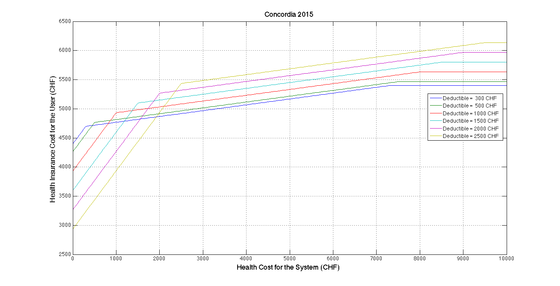

Taking this into account, I took the work of plotting in my computer the total health costs for the user as a function of the total health cost incurred.

Case 1: If you are perfectly healthy and never go to the doctor, the total cost incurred is zero, and the health insurance cost for the user is the fixed term, i.e., just the 12 monthly primes. Of course you're best choice is to go for the highest deductible (2500 CHF), which goes along with the lowest monthly primes.

Case 2: If you are in bad health and go often to the doctor or have a major operation, the total cost incurred will be very high, and you will be better off with the lowest deductible (300 CHF), because despite the higher monthly primes, once you have passed the 300 CHF deductible, 90% of the rest will be covered by the insurance.

Case 3: ... for most of us, we will be somewhere in between. But does it mean that the optimal deductible is somewhere between the minimum 300 and the maximum 2500 CHF? In most cases, No!

After plotting the curves for my insurance (Assura) I noticed that 300CHF was the optimal deductible if I incurred total costs over 2000 CHF in the year, and 2500 CHF was the optimal deductible if I incurred less than 200CHF cost in health during the year.

i.e., ... all the other deductibles (500, 1000, 1500, 2000 CHF) would never be optimal!! No matter how high the health costs incurred, with an intermediate franchise, at the end of the year, you would end up paying more than if you had gone for the minimum or for the maximum deductible. Of course, only one of the two will be optimal ... but even if you choose "the wrong one", you would still pay less than with any of the intermediate deductibles !!

And it is not an exception. I repeated the same exercise with 3 different insurance companies (Assura, Concordia, Swica), collecting their data for the monthly primes for all possible deductibles [*]: for the four of them the conclusion was the same : the intermediate deductibles were never optimal, no matter what the total health cost incurred were.

To sum up: never choose an intermediate deductible. Go for 300 CHF if in bad health, or 2500 CHF if in good health. Here in good health means that you expect to incurr in health costs for less than around two thousand francs in the year. Even if you expect no costs, choose a deductible of 2500 CHF. Even if in the end you end up having major operations with high cost involved, you will stay pay less at the end of the year that if you had opted an intermediate deductible of, let's say, 1000 CHF. Surprising, but true!!

As said, I have only done the complete calculation for four insurane companies,. ... but I presume that it must be the same for most of them.

So then, this raises the ethical/legal/practical question of "Why do these companies offer intermediate deductibles?" How can it be legal, knowing that no matter what, the cost for the user who chooses them is never going to be optimal?

Any hints?

Cheers,

[*] The raw data for this analysis were obtained from: http://www.priminfo.ch/praemien/praemien_dat/CH.pdf