An interesting discussion about the topic:

An interesting discussion about the topic:

http://www.youtube.com/watch?v=X2lqcZIv4XI

Watched it. I found interesting, that they also posed France into the countries with problems with a strong Euro. Had already heard about the lower amount of savings in Germany compared with southern countries.

Even though I like people posting videos, I would like more if those posting videos would also give a brief description and would voice their own opnion.

Watched it. I found interesting, that they also posed France into the countries with problems with a strong Euro. Had already heard about the lower amount of savings in Germany compared with southern countries.

Even though I like people posting videos, I would like more if those posting videos would also give a brief description and would voice their own opnion.

I don't want to add much to the discussion of Anil Kashyap, Veronica Guerrieri and Hans-Werner Sinn at Chicago Booth about the eurocrises (this is the required description of the video :-)) from the economic perspective, because I don't think that I can beat these professors in their special subjects.

However what I can do is to share some personal impressions, which I got in this financial crises during the last years. The most surprising thing for me in this eurocrises has been how strong it changed and affected the climate between European states and the propaganda war which it caused in parts of the European media. Personally this gave me a slight idea to understand better what has once already happened in the 1930s with the known consequences. In short: the fragility of peace and democracy in times of crises.

A second impression is the incredible power of the financial markets and I think it is not overstated to say that banks and the financial industry are nowadays much more powerfull than nation states. For me there exist three main forces in this game called "eurocrises":

1. The Northern European states which are tired of bailing out and which want to limit their transfers to other countries.

2. The Southern European states which are desperately looking for an escape from deflation and unemployment.

3. The financial speculators, which are systematically putting the Southern states under fire and some of them are even so cocky to cry for debt mutualisation at the same time (like Soros).

So, and now it's your turn. What's your impression and how has it changed?

I don't want to add much to the discussion of Anil Kashyap, Veronica Guerrieri and Hans-Werner Sinn at Chicago Booth about the eurocrises (this is the required description of the video :-)) from the economic perspective, because I don't think that I can beat these professors in their special subjects.

However what I can do is to share some personal impressions, which I got in this financial crises during the last years. The most surprising thing for me in this eurocrises has been how strong it changed and affected the climate between European states and the propaganda war which it caused in parts of the European media. Personally this gave me a slight idea to understand better what has once already happened in the 1930s with the known consequences. In short: the fragility of peace and democracy in times of crises.

A second impression is the incredible power of the financial markets and I think it is not overstated to say that banks and the financial industry are nowadays much more powerfull than nation states. For me there exist three main forces in this game called "eurocrises":

1. The Northern European states which are tired of bailing out and which want to limit their transfers to other countries.

2. The Southern European states which are desperately looking for an escape from deflation and unemployment.

3. The financial speculators, which are systematically putting the Southern states under fire and some of them are even so cocky to cry for debt mutualisation at the same time (like Soros).

So, and now it's your turn. What's your impression and how has it changed?

Hey, when we think, we can't beat some pesky profs in their field, what reason do we have to get out of bed at all? ;)

It was the second time in recent days, that I heard about the wealth difference between north and south. I am not sure though, that all factors, like higher pensions in the north, have been included. I would also like to know, how much wealth in the south is in the form of "dormant goods". Like cash (without intrests), houses which generate no income), etc. Spain especially has a huge bubble in housings which when it burts, will make the US problems look tiny.

An other part I missed was the position of the UK, being one of the northern states, but not being part of the Eurozone. Could the northern states take the GBP as currency and leave the Euro for the rest? Or take the Swiss Franc, wo do have the most beautiful money anyway ;)

Last but not least, I would have also liked to hear more about the duality of debts. If you have debts, like the south, someone has assets. What the south pays in interests, someone gets paid. Therefore, it seems to my non-professor-eyes, that if we would reduce the debt of the south, someone would loose assets???

Hey, when we think, we can't beat some pesky profs in their field, what reason do we have to get out of bed at all? ;)

It was the second time in recent days, that I heard about the wealth difference between north and south. I am not sure though, that all factors, like higher pensions in the north, have been included. I would also like to know, how much wealth in the south is in the form of "dormant goods". Like cash (without intrests), houses which generate no income), etc. Spain especially has a huge bubble in housings which when it burts, will make the US problems look tiny.

An other part I missed was the position of the UK, being one of the northern states, but not being part of the Eurozone. Could the northern states take the GBP as currency and leave the Euro for the rest? Or take the Swiss Franc, wo do have the most beautiful money anyway ;)

Last but not least, I would have also liked to hear more about the duality of debts. If you have debts, like the south, someone has assets. What the south pays in interests, someone gets paid. Therefore, it seems to my non-professor-eyes, that if we would reduce the debt of the south, someone would loose assets???

The three professors seem to be of the opinion, which is widely held (though only in hindsight of course), that 'the euro could never work because the countries involved are too different'. This seems to ignore the fact that many countries have huge disparities within their borders, but are happy enough using one national currency. Compare London with, say, Middlesborough or Swansea and you could conclude that 'the pound can never work because the parts of the UK are too different'. Or take the US: the fiscal policies which are best for New York are probably not the best for Detroit or small-town Idaho, but they are all stuck with the same currency. Would the US really be better off if each state had its own currency?

Of course there are some differences in the Eurozone case: at least people in different towns in the UK are taxed according to the same rules (although this isn't the case for some kinds of taxes in the US). The fact that tax collection in the Southern European countries is (perceived to be) inefficient and corrupt makes Northern Europeans understandably unwilling to help out when S. European governments run out of money.

The three professors seem to be of the opinion, which is widely held (though only in hindsight of course), that 'the euro could never work because the countries involved are too different'. This seems to ignore the fact that many countries have huge disparities within their borders, but are happy enough using one national currency. Compare London with, say, Middlesborough or Swansea and you could conclude that 'the pound can never work because the parts of the UK are too different'. Or take the US: the fiscal policies which are best for New York are probably not the best for Detroit or small-town Idaho, but they are all stuck with the same currency. Would the US really be better off if each state had its own currency?

Of course there are some differences in the Eurozone case: at least people in different towns in the UK are taxed according to the same rules (although this isn't the case for some kinds of taxes in the US). The fact that tax collection in the Southern European countries is (perceived to be) inefficient and corrupt makes Northern Europeans understandably unwilling to help out when S. European governments run out of money.

The three professors seem to be of the opinion, which is widely held (though only in hindsight of course), that 'the euro could never work because the countries involved are too different'. This seems to ignore the fact that many countries have huge disparities within their borders, but are happy enough using one national currency. Compare London with, say, Middlesborough or Swansea and you could conclude that 'the pound can never work because the parts of the UK are too different'. Or take the US: the fiscal policies which are best for New York are probably not the best for Detroit or small-town Idaho, but they are all stuck with the same currency. Would the US really be better off if each state had its own currency?

Of course there are some differences in the Eurozone case: at least people in different towns in the UK are taxed according to the same rules (although this isn't the case for some kinds of taxes in the US). The fact that tax collection in the Southern European countries is (perceived to be) inefficient and corrupt makes Northern Europeans understandably unwilling to help out when S. European governments run out of money.

Good examples from the UK and the US and I agree with you that it could theoretically also work in Europe. However it would need huge financial transfers to maintain a currency union between countries with such different levels of competitiveness. And there is no chance to get the approval of the people for such a step without the establishement of a political union with common rules and standards or something like a soft European federation .

The problem is that the essential more European integration doesn't seem to be popular enough in the European population. Further integration steps are extremely hard to achieve. Just look what happened with the Lisbon Treaty (fromerly called European constitution) in France, the Netherlands and Ireland or have a look about the Greek reaction to the bailout conditions. As much as I would wish to see such a political union this crises made me much more sceptical that it can be achieved.

Good examples from the UK and the US and I agree with you that it could theoretically also work in Europe. However it would need huge financial transfers to maintain a currency union between countries with such different levels of competitiveness. And there is no chance to get the approval of the people for such a step without the establishement of a political union with common rules and standards or something like a soft European federation .

The problem is that the essential more European integration doesn't seem to be popular enough in the European population. Further integration steps are extremely hard to achieve. Just look what happened with the Lisbon Treaty (fromerly called European constitution) in France, the Netherlands and Ireland or have a look about the Greek reaction to the bailout conditions. As much as I would wish to see such a political union this crises made me much more sceptical that it can be achieved.

Hey, when we think, we can't beat some pesky profs in their field, what reason do we have to get out of bed at all? ;)

It was the second time in recent days, that I heard about the wealth difference between north and south. I am not sure though, that all factors, like higher pensions in the north, have been included. I would also like to know, how much wealth in the south is in the form of "dormant goods". Like cash (without intrests), houses which generate no income), etc. Spain especially has a huge bubble in housings which when it burts, will make the US problems look tiny.

An other part I missed was the position of the UK, being one of the northern states, but not being part of the Eurozone. Could the northern states take the GBP as currency and leave the Euro for the rest? Or take the Swiss Franc, wo do have the most beautiful money anyway ;)

Last but not least, I would have also liked to hear more about the duality of debts. If you have debts, like the south, someone has assets. What the south pays in interests, someone gets paid. Therefore, it seems to my non-professor-eyes, that if we would reduce the debt of the south, someone would loose assets???

Hey, you are right that we have to challenge the profs, thus my comment was a bit imprudent.

My personal impression about the wealth distribution in Europe is that the infrastructure in Southern Europe is not worse than in the North, while the protection with social systems seems to be worse there. The result in the ECB study seems to have the reason that in Southern Europe private house ownership is much more common than in Germany, where much more people are renting their appartments (similar like in Switzerland).

Northern Europe taking the GBP or CHF as a curreny? Haha! No, this won't happen. There are two theoretical options for the case of a euro breakup: All countries go back to their fromer national currencies or the creation of a Northern and a Southern euro. However returning back to national currencies is easier said than done. So far not even Greece wanted to do that. And the creation of two different eurozones (North and South euro) maybe sounds economically resonable, but could in fact mean the end of the Franco-German cooperation which has facilitated political stability in Europe during the last 50 years.

Concerning the mutuality of debts: there have already been debt cuts in Greece and a bank deposit levy in Cyprus and this seems to be a role model for possible futural bailouts as well. You are right that the creditors of Southern European states are not only Southern banks and citizens, but also French, German, Dutch, British and American, etc banks and financial institutions. These creditors have particularly been saved through the bailouts while the tax payers and normal citizens have to carry the burden. That's why I wrote in my other comment that the financial institutions seem to rule the world. They privatize their profits, but try to socialize their losses. Too big to fail is usually what they cry when they want to get saved.

Hey, you are right that we have to challenge the profs, thus my comment was a bit imprudent.

My personal impression about the wealth distribution in Europe is that the infrastructure in Southern Europe is not worse than in the North, while the protection with social systems seems to be worse there. The result in the ECB study seems to have the reason that in Southern Europe private house ownership is much more common than in Germany, where much more people are renting their appartments (similar like in Switzerland).

Northern Europe taking the GBP or CHF as a curreny? Haha! No, this won't happen. There are two theoretical options for the case of a euro breakup: All countries go back to their fromer national currencies or the creation of a Northern and a Southern euro. However returning back to national currencies is easier said than done. So far not even Greece wanted to do that. And the creation of two different eurozones (North and South euro) maybe sounds economically resonable, but could in fact mean the end of the Franco-German cooperation which has facilitated political stability in Europe during the last 50 years.

Concerning the mutuality of debts: there have already been debt cuts in Greece and a bank deposit levy in Cyprus and this seems to be a role model for possible futural bailouts as well. You are right that the creditors of Southern European states are not only Southern banks and citizens, but also French, German, Dutch, British and American, etc banks and financial institutions. These creditors have particularly been saved through the bailouts while the tax payers and normal citizens have to carry the burden. That's why I wrote in my other comment that the financial institutions seem to rule the world. They privatize their profits, but try to socialize their losses. Too big to fail is usually what they cry when they want to get saved.

Hi Simon,

I don't agree that "huge financial transfers to maintain a currency union between countries with such different levels of competitiveness".

Currently, such huge transfers are indeed taking place, but that is because of the current banking crisis. Banks and governments in Southern Europe were allowed to borrow large amounts at good rates because these loans were implicitly backed by the whole Eurozone (that is, the markets chose to believe that Euro loans were the same whether given to Germany or greece, and the EU / ECB chose not to make clear that there was no European guarantee of loans made to individual states). This allowed S. European countries to live beyond their means, and have the same standard of living as N. Europe (but with more sun and better food), and then pass the bill (mostly) to Germany when things went wrong. Probably the best point made in the video is that the limits of eurozone support in such cases should have been made clear from the start, including rules & provisions for countries to leave or be kicked out if necessary.

In addition, there was from the start of the EU (not eurozone) some kind of 'solidariy' envisioned, for example with CAP which favours S. Europe and more recently with development funds for the Eastern European members. This also means transfers from North to South.

However, I would argue that neither of these is actually necessary for a successful currency union. They are necessary only if you think that sharing a currency must also mean you are entitled to the same standard of living.

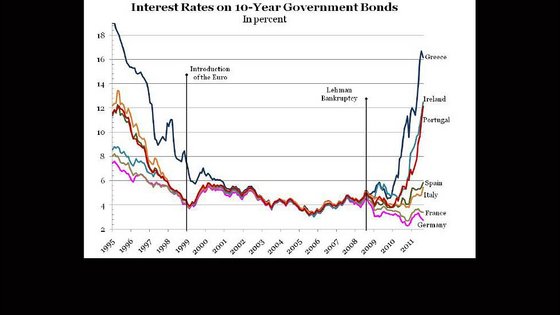

I find this graph very interesting. My interpretation is that the current 'crisis' is really just a regression to the mean. The financial situation in Southern European countries now is no worse than it was before the Euro. During the first ten years of the eurozone it falsely appeared much better, but in reality changing the currency does not overnight change the economy, and things were much as before. Now, as things return to 'normal', they can no longer afford the standard of living they briefly had. Of course, this sudden re-adjustment is very painful for the economy, causing huge unemployment and real suffering, because these coutries are being expected to suddenly make good on years of excess.

Hi Simon,

I don't agree that "huge financial transfers to maintain a currency union between countries with such different levels of competitiveness".

Currently, such huge transfers are indeed taking place, but that is because of the current banking crisis. Banks and governments in Southern Europe were allowed to borrow large amounts at good rates because these loans were implicitly backed by the whole Eurozone (that is, the markets chose to believe that Euro loans were the same whether given to Germany or greece, and the EU / ECB chose not to make clear that there was no European guarantee of loans made to individual states). This allowed S. European countries to live beyond their means, and have the same standard of living as N. Europe (but with more sun and better food), and then pass the bill (mostly) to Germany when things went wrong. Probably the best point made in the video is that the limits of eurozone support in such cases should have been made clear from the start, including rules & provisions for countries to leave or be kicked out if necessary.

In addition, there was from the start of the EU (not eurozone) some kind of 'solidariy' envisioned, for example with CAP which favours S. Europe and more recently with development funds for the Eastern European members. This also means transfers from North to South.

However, I would argue that neither of these is actually necessary for a successful currency union. They are necessary only if you think that sharing a currency must also mean you are entitled to the same standard of living.

I find this graph very interesting. My interpretation is that the current 'crisis' is really just a regression to the mean. The financial situation in Southern European countries now is no worse than it was before the Euro. During the first ten years of the eurozone it falsely appeared much better, but in reality changing the currency does not overnight change the economy, and things were much as before. Now, as things return to 'normal', they can no longer afford the standard of living they briefly had. Of course, this sudden re-adjustment is very painful for the economy, causing huge unemployment and real suffering, because these coutries are being expected to suddenly make good on years of excess.

Here is a question for everyone:

Since the start of the crisis, is has been generally assumed that a Eurozone country defaulting would be synonymous with that coutry leaving the Euro. Why? What would actually happen if e.g. Greece defaulted on it's sovereign debt, and why would that automatically mean it couldn't keep using the euro?

Here is a question for everyone:

Since the start of the crisis, is has been generally assumed that a Eurozone country defaulting would be synonymous with that coutry leaving the Euro. Why? What would actually happen if e.g. Greece defaulted on it's sovereign debt, and why would that automatically mean it couldn't keep using the euro?

Adam, in fact there have already been debt cuts for Greece. However it seems that all these debt cuts don't sustainably help as long as there are no real structural reforms or a currency devaluation in the country. And new budget deficts would quickly lead to high debt levels again.

As a consequence there would have to be debt cuts every 5 or 10 years in such a scenario. Which investor is still willing to lend money to a country in this case? And if the investors don't lend new money the loans from other countries would have to become permanent transfers. The problem is that permanent transfers are not accepted in the debtor countries (because without a political union there is no real control about what happens with that money) nor in the creditor countries (because the terms and conditions of the loans are seen as a limitation of national souverignity).

Adam, in fact there have already been debt cuts for Greece. However it seems that all these debt cuts don't sustainably help as long as there are no real structural reforms or a currency devaluation in the country. And new budget deficts would quickly lead to high debt levels again.

As a consequence there would have to be debt cuts every 5 or 10 years in such a scenario. Which investor is still willing to lend money to a country in this case? And if the investors don't lend new money the loans from other countries would have to become permanent transfers. The problem is that permanent transfers are not accepted in the debtor countries (because without a political union there is no real control about what happens with that money) nor in the creditor countries (because the terms and conditions of the loans are seen as a limitation of national souverignity).

Shaun, I agree with you that the introduction of the euro in the 90s under the given conditions has to be seen as a mistake from todays perspective. As Mr. Sinn said in the interview one has to be a masochist to think otherwise, So, one can congratulate the UK to have stayed out of it.

However you should be aware that the Franco-German core is no homogenous block. Especially since the start of the financial crises it became obvious that the French and the German government have different visions concerning the monetary union. For example the non-bailout rule has always be seen as a very important component of the Maastricht treaty, while it doesn't seem to play such a big role in France.

Furthermore the Bundesbank and the Dutch government would have prefered a smaller number of countries to start with the eurozone, while France prefered to include more countries from the very beginning. As usual in the EU the result has been a rotten compromise: in this case Germany got the non-bailout clause, while France got its way to let all Southern countries in from the start.

Shaun, I agree with you that the introduction of the euro in the 90s under the given conditions has to be seen as a mistake from todays perspective. As Mr. Sinn said in the interview one has to be a masochist to think otherwise, So, one can congratulate the UK to have stayed out of it.

However you should be aware that the Franco-German core is no homogenous block. Especially since the start of the financial crises it became obvious that the French and the German government have different visions concerning the monetary union. For example the non-bailout rule has always be seen as a very important component of the Maastricht treaty, while it doesn't seem to play such a big role in France.

Furthermore the Bundesbank and the Dutch government would have prefered a smaller number of countries to start with the eurozone, while France prefered to include more countries from the very beginning. As usual in the EU the result has been a rotten compromise: in this case Germany got the non-bailout clause, while France got its way to let all Southern countries in from the start.